At IC Credit Union, we believe that financial literacy is key to making informed decisions that positively impact your life. In our ongoing financial education series, we’ve covered essential topics like budgeting, saving, and investing. Now, we’re turning our attention to a topic that plays a crucial role in your financial journey: understanding credit scores and credit reports.

What is A Credit Score?

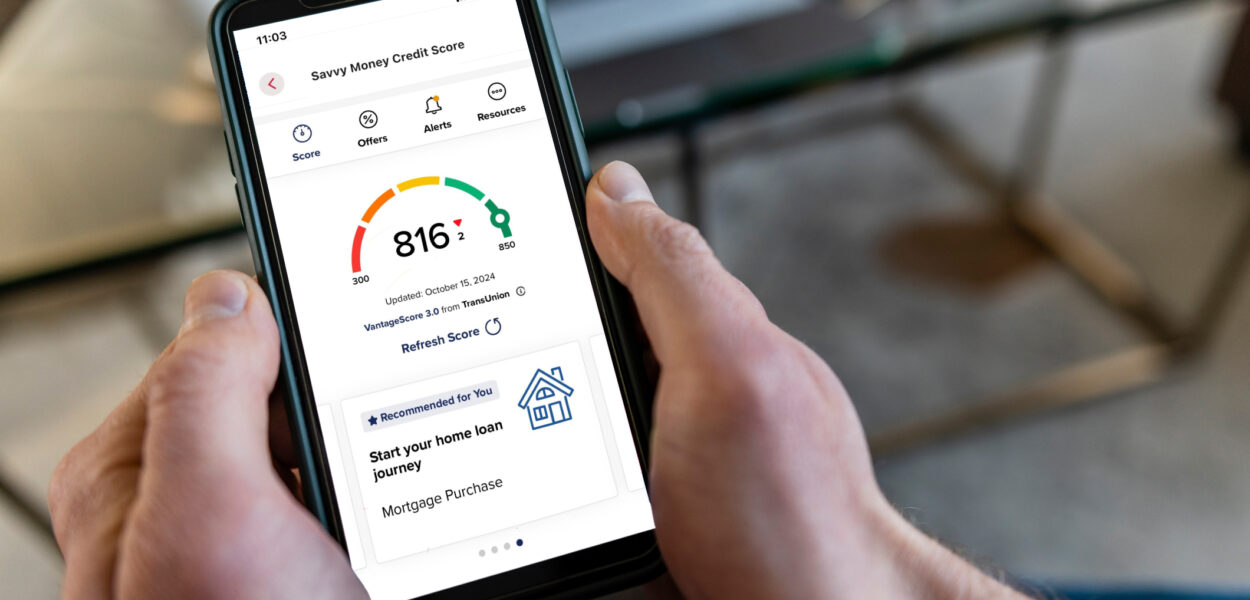

A credit score is a three-digit number that represents your creditworthiness, or the likelihood that you will repay borrowed money on time. Lenders, landlords, and even employers use credit scores to evaluate your financial reliability. The most commonly used credit scores are FICO® scores, which range from 300 to 850, with higher scores indicating better creditworthiness.

What is A Credit Report

Your credit report is a detailed record of your credit history, including information about your borrowing and repayment habits. It contains data on credit accounts (such as credit cards, mortgages, and loans), payment history, outstanding balances, and any public records like bankruptcies or tax liens. The three major credit bureaus—Equifax, Experian, and TransUnion—compile and maintain credit reports.

Why Are Credit Scores and Credit Reports Important?

Your credit score and credit report are vital to your financial health for several reasons:

- Loan Approval: Lenders use your credit score and credit report to determine whether to approve your application for credit, such as a mortgage, car loan, or credit card. A higher credit score increases your chances of approval and may qualify you for lower interest rates.

- Interest Rates: Your credit score directly impacts the interest rates you’re offered. A higher score can lead to lower rates, saving you money over the life of a loan. Conversely, a lower score can result in higher interest rates and more costly borrowing.

- Renting a Home: Landlords often check credit reports to assess the risk of renting to a potential tenant. A strong credit history can make you a more attractive candidate, while a poor credit history may limit your rental options.

- Employment Opportunities: Some employers check credit reports as part of their hiring process, especially for positions that involve financial responsibility. A good credit report can enhance your job prospects, while a negative report might raise concerns.

- Insurance Premiums: Insurance companies may use credit scores to help determine premiums for auto and homeowners insurance. A higher credit score could result in lower premiums.

What Affects Your Credit Score

Understanding the factors that influence your credit score can help you take steps to improve it. The main factors include:

- Payment History (35%): Your payment history is the most significant factor in your credit score. Late or missed payments can negatively impact your score, while consistent on-time payments can improve it.

- Credit Utilization (30%): Credit utilization refers to the amount of credit you’re using compared to your total credit limit. It’s best to keep your credit utilization below 30% to maintain a healthy credit score.

- Length of Credit History (15%): The longer your credit history, the better. A longer credit history demonstrates your experience with managing credit, which can positively impact your score.

- Types of Credit (10%): Having a mix of different types of credit accounts (such as credit cards, installment loans, and mortgages) can improve your credit score, as it shows you can manage various types of credit responsibly.

- Recent Credit Inquiries (10%): Each time you apply for new credit, a hard inquiry is recorded on your credit report. Too many inquiries in a short period can lower your score, as it may indicate increased risk.

How to Obtain and Review Your Credit Report

You’re entitled to a free credit report from each of the three major credit bureaus once every 12 months through AnnualCreditReport.com. Regularly reviewing your credit report allows you to:

- Check for Accuracy: Ensure that all information on your credit report is accurate. Errors, such as incorrect account details or late payments, can harm your credit score.

- Identify Fraud: Reviewing your credit report can help you spot signs of identity theft, such as unfamiliar accounts or inquiries. If you notice anything suspicious, report it to the credit bureau immediately.

- Monitor Your Progress: Keeping an eye on your credit report allows you to track your credit score over time and see the impact of your financial decisions.

How to Improve Your Credit Score

If your credit score isn’t where you want it to be, don’t worry—there are steps you can take to improve it:

- Pay Bills on Time: Always pay at least the minimum payment on time to avoid late fees and negative marks on your credit report.

- Reduce Credit Card Balances: Aim to pay down your credit card balances to lower your credit utilization ratio. Consider focusing on paying off high-interest debt first.

- Avoid Opening New Credit Accounts Unnecessarily: Each new credit inquiry can lower your score slightly, so only apply for new credit when necessary.

- Keep Old Accounts Open: Even if you’re not using them, keeping older credit accounts open can benefit your credit score by lengthening your credit history.

- Diversify Your Credit: If you have only one type of credit, consider diversifying with a different type, such as a small personal loan, to improve your score over time.

Conclusion

Understanding your credit score and credit report is a crucial step in managing your financial health. A strong credit score opens doors to better financial opportunities, from lower interest rates to improved rental and job prospects. At IC Credit Union, we’re here to help you navigate the world of credit with confidence.

Stay tuned for more valuable insights in our financial education series, where we’ll continue to explore key topics that empower you to make smart financial decisions. If you have any questions about your credit score or need personalized advice, don’t hesitate to reach out—we’re here to support your financial journey!